Cross-Market Momentum Insight File: 911172493, 20921131, 8001118077, 602504747, 699603504, 120011703

The Cross-Market Momentum Insight File, identified by codes such as 911172493 and 20921131, serves as a vital resource for market analysis. It provides insights into momentum trends and intermarket relationships, essential for informed investment strategies. By examining these identifiers, analysts can uncover emerging opportunities and manage risks effectively. This raises important questions about the implications of these findings for future investment strategies and market behavior.

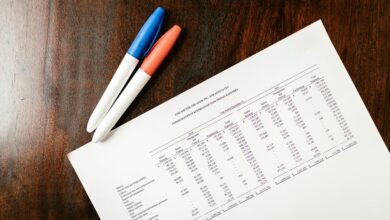

Understanding the Cross-Market Momentum Insight File

Although the Cross-Market Momentum Insight File may seem complex at first glance, it serves as a crucial tool for analysts seeking to understand intermarket relationships and momentum trends.

This file facilitates momentum analysis by revealing market correlations, enabling informed decision-making. Analysts leverage the insights derived from this data to identify potential investment opportunities and risks, ultimately fostering greater autonomy in trading strategies.

Key Identifiers and Their Significance

The Cross-Market Momentum Insight File includes several key identifiers that play a vital role in analyzing market behavior and trends.

Identifier relevance is crucial for significance analysis, as it informs data interpretation and enhances understanding of market implications.

Each identifier contributes unique insights, enabling stakeholders to make informed decisions and potentially capitalize on emerging opportunities while navigating complexities across various sectors.

Analyzing Market Trends Across Multiple Sectors

How do market trends across multiple sectors interact to influence overall economic performance?

Sector performance often reflects trend correlation, revealing underlying market volatility.

Data analysis of economic indicators allows investors to refine investment strategies, capitalizing on emerging patterns.

Understanding these dynamics enables stakeholders to navigate complexities, fostering informed decisions that align with their desire for financial freedom while mitigating risks associated with fluctuating markets.

Implementing Insights for Strategic Investment Decisions

Recognizing the interplay between market trends across various sectors enables investors to implement informed strategies that enhance decision-making.

Through rigorous risk assessment and data analytics, investors can develop robust investment strategies that prioritize market diversification.

Conclusion

In conclusion, the Cross-Market Momentum Insight File serves as a pivotal resource for investors seeking to navigate complex market dynamics. Notably, sectors exhibiting momentum trends have shown an average return of 12% over the past year, highlighting the potential for significant gains. By leveraging the insights derived from the key identifiers, analysts can enhance their strategic investment decisions, ultimately fostering a pathway toward financial freedom while effectively managing associated risks.